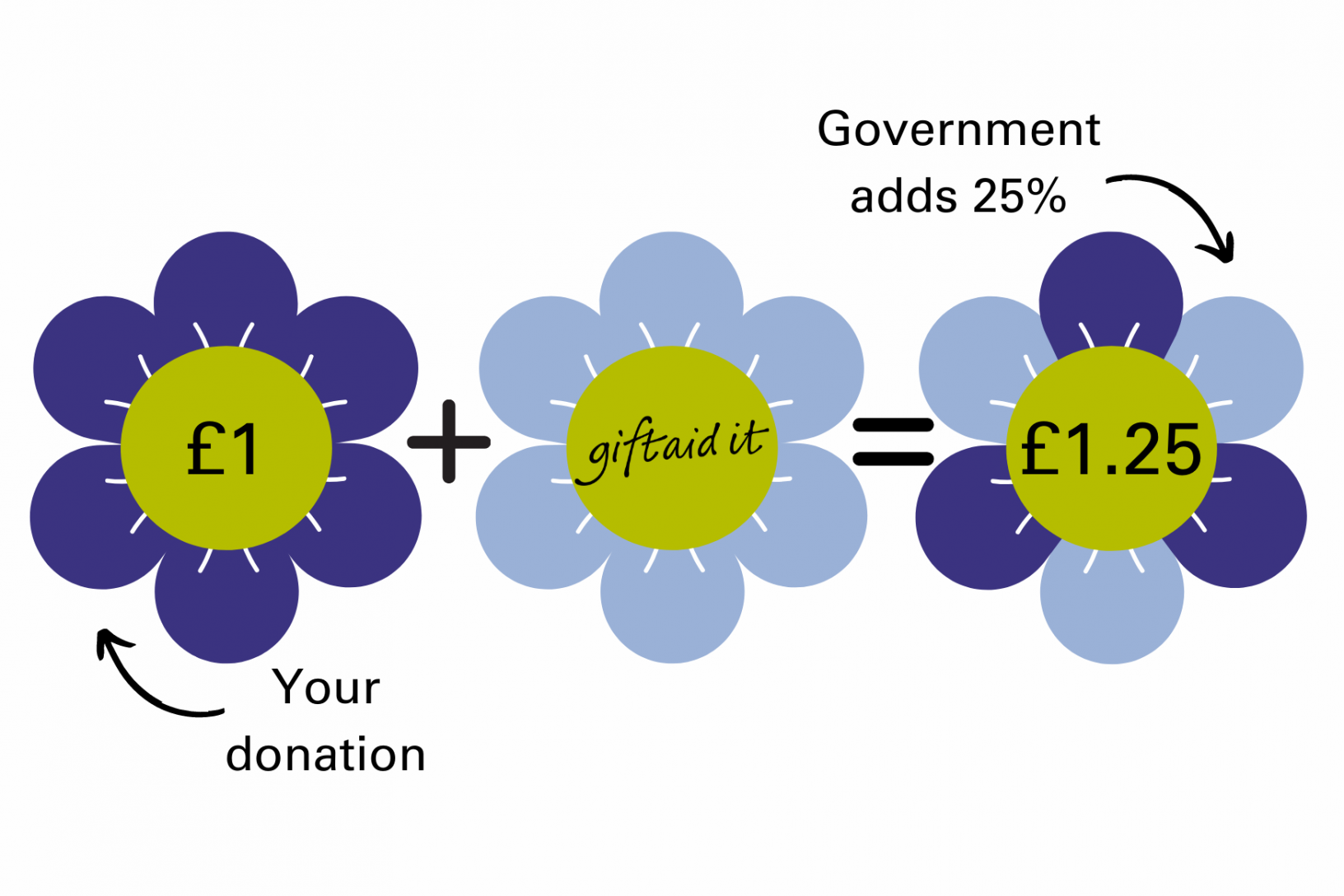

If you pay Income Tax or Capital Gains Tax*, and you want to make your donation to Thrive go further, then sign up to Gift Aid and Thrive will claim 25p for every £1 you donate from HMRC.

Gift Aid will be claimed on any donations that you have made in the last 4 years and will continue to be claimed on any future donations until you tell us to stop. Please let us know if you stop paying tax in the future or wish us to stop claiming Gift Aid. Let us know by emailing the fundraising team at fundraising@thrive.org.uk

Please make sure to select 'yes, I would like Thrive to claim Gift Aid on my past and future donations' if you are signing up to Gift Aid.

*The extra 25% that the government adds is taken from the tax that you paid in the year of your donation. Gift aid can be claimed on any donations up to 4 times the amount of tax you paid - after this, it is your responsibility to pay the difference.